Download the original PDF using the button below.

After months of negotiations, a new tax and spending bill was signed into law by President Trump on July 4. This budget is sweeping in scope, making many provisions of the Tax Cuts and Jobs Act permanent, raising state and local tax exemptions, extending estate tax limits, and more.

While there is political debate, the bill removes the risk of a “tax cliff” at year-end. For individuals, the provisions directly impact household finances, and for investors, the broader implications around debt and spending carry weight for long-term planning.

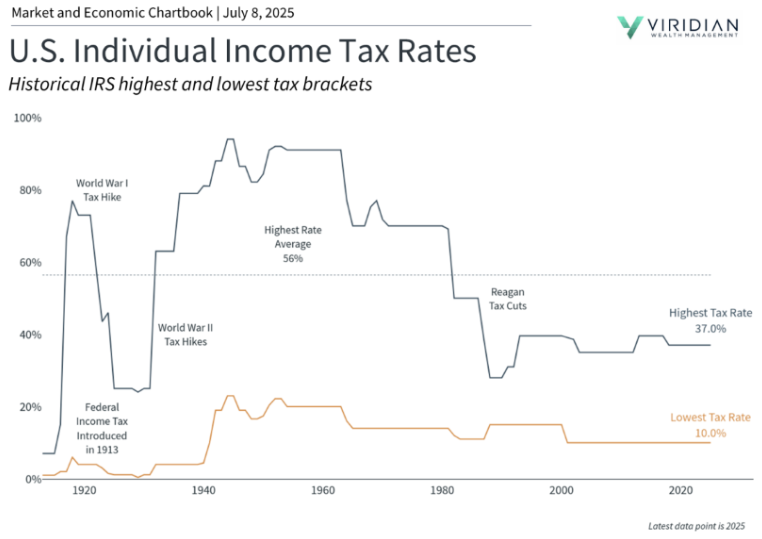

The Tax Cuts and Jobs Act Rates Are Now Permanent

The “One Big Beautiful Bill” extends and expands several key aspects of the 2017 Tax Cuts and Jobs Act:

- Tax brackets permanent: Originally set to expire in 2025, current TCJA rates remain in place.

- Standard deduction increases: $15,750 for single filers and $31,500 for joint filers in 2025.

- Senior bonus: An additional $6,000 deduction for qualifying seniors, phasing out at $75,000 income, expires in 2028.

- Alternative minimum tax: Exemption now permanent, with thresholds indexed to inflation.

- Child tax credit: Rises from $2,000 to $2,200 per child, indexed to inflation.

- SALT deduction: Cap rises from $10,000 to $40,000, with gradual annual increases until 2029.

- Tip income deduction: Up to $25,000 for workers earning less than $150,000, effective through 2028.

- Repeals certain green energy credits, including for electric vehicles.

- Federal debt ceiling raised by $5 trillion, reducing near-term uncertainty over debt limit debates.

- Business incentives expanded to encourage domestic investment.

These measures sustain the low-tax environment that has prevailed in recent decades.

Growing Concerns Over Fiscal Deficits

Tax cuts reduce government revenue, often requiring either spending cuts or higher borrowing. Key facts from 2025 federal spending:

- 21% Social Security

- 14% Medicare

- 13% Defense

- 14% Interest on existing debt

The Congressional Budget Office estimates this bill will add $3.4 trillion to the national debt over the next decade, pushing total federal debt beyond 120% of GDP, or $36.2 trillion.

While tax cuts can spur growth, history shows Washington has struggled to balance budgets. The last surplus occurred in the 1990s under President Clinton.

For investors, higher debt levels may eventually influence interest rates and inflation expectations, though worst-case scenarios have yet to materialize. The key remains diversification and long-term planning rather than short-term reactions.

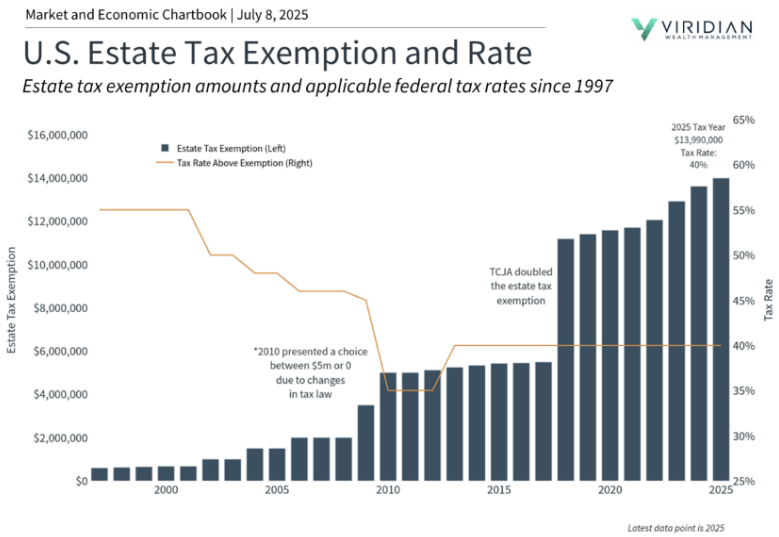

Higher Estate Tax Exemptions Made Permanent

The bill makes permanent the higher estate tax exemption set by the TCJA:

- $15 million for individuals

- $30 million for couples beginning in 2026

While many assume estate taxes apply only to the wealthy, every family benefits from proactive estate planning. This includes strategies around tax efficiency, philanthropy, and long-term wealth transfer.

The Bottom Line

The new bill extends a favorable tax environment for individuals and businesses alike. While fiscal deficits and rising debt are important considerations, investors should maintain a disciplined, long-term approach rather than reacting to political and policy shifts.

👉 Looking to understand how the “One Big Beautiful Bill” affects your retirement strategy or investment plan? Schedule a consultation with Anita Niefeldt, CFP®, today.