Download the original PDF using the button below.

Introduction: Don’t Fight the Fed

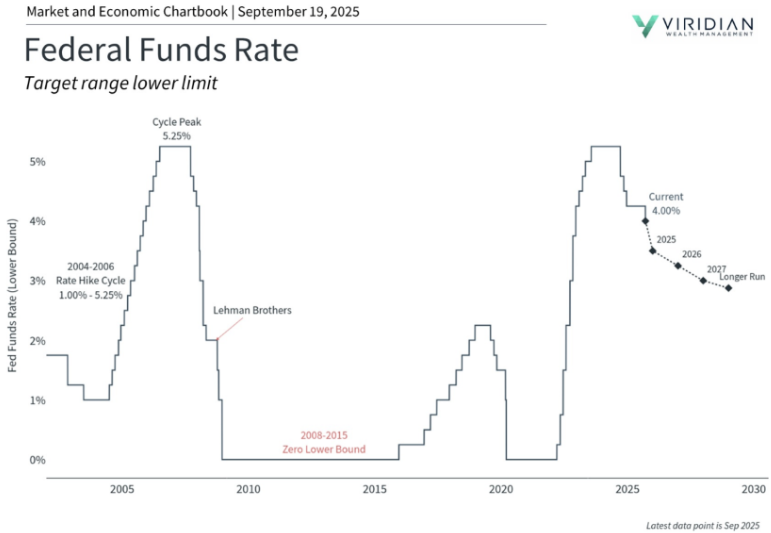

The famous investing principle “don’t fight the Fed” has guided investors since the 1970s. The Federal Reserve’s monetary policy decisions can shape both markets and the economy. As the Fed continues its rate-cutting cycle in 2025, investors should consider how these moves impact their portfolios — while keeping a long-term perspective.

At its September meeting, the Fed cut policy rates by 0.25%, extending the easing cycle that began in 2024. Unlike the emergency cuts of 2008 or 2020, today’s moves are aimed at sustaining growth in a mixed economic environment.

Why the Fed is Cutting Rates in 2025

Understanding the why behind the Fed’s decisions is more important than focusing on the when or how much.

- Rate Cuts Were Expected: Fed projections have consistently pointed toward easing. Two more cuts are possible this year.

- Different from Crisis Cuts: Unlike 2008 or 2020, today’s cuts are about fine-tuning after rapid hikes in 2022.

- Political & Market Forces Ahead: With Jerome Powell’s term ending in 2026 and a new Fed chair likely under President Trump, the federal funds rate may trend lower — but long-term rates depend on market forces, not politics.

In short, the Fed is signaling continued support for economic expansion.

Mixed Signals in the Economy

Recent economic data shows both strength and weakness:

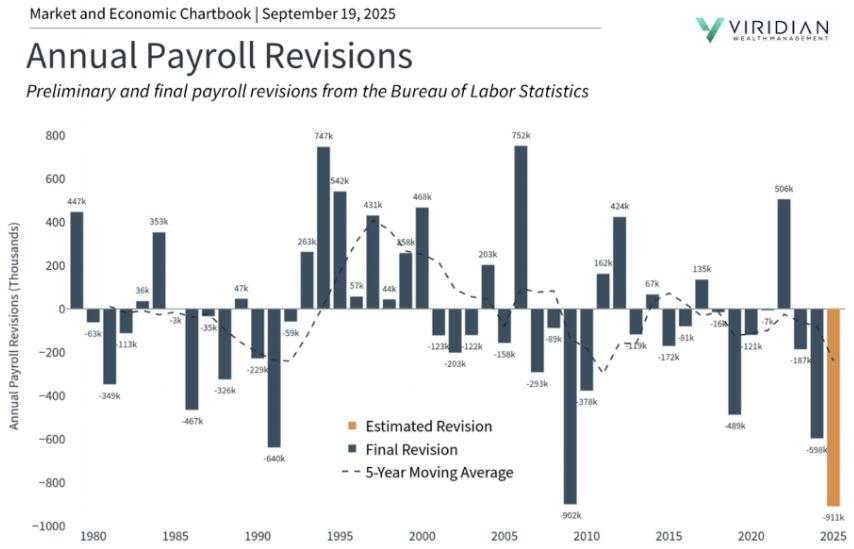

- Labor Market Cooling: Only 22,000 jobs were added in August 2025. The unemployment rate rose slightly to 4.3%, with downward revisions revealing 911,000 fewer jobs created from 2024–2025.

- Stubborn Inflation: The Fed’s preferred inflation measure, the PCE Price Index, is still at 2.6%. Core PCE (2.9%) and CPI (2.9–3.1%) remain above the Fed’s 2% target.

This balancing act between slowing jobs growth and persistent inflation explains why Fed officials — and markets — remain divided.

How Fed Rate Cuts Impact Investors

For long-term investors, the main question is whether rate cuts signal recession or expansion. So far, there’s no recession signal. In this environment, rate cuts can benefit both businesses and households:

- Businesses enjoy cheaper borrowing costs for expansion.

- Consumers may spend more as mortgage and credit card rates decline.

- Stock Market: Historically, equities perform well after rate cuts, as lower rates boost earnings potential.

- Bonds: Typically increase in value, though results vary by maturity and sector.

- Cash: Becomes less attractive as yields decline.

History shows that rate cuts usually support financial markets — especially when they’re not tied to crisis conditions.

Investment Takeaways for 2025

- Rate cuts in 2025 are about fine-tuning, not rescuing.

- Mixed economic data means volatility is likely, but no recession has emerged.

- Stocks and bonds may benefit, while cash loses appeal.

- Investors should maintain a long-term view, focusing on goals rather than reacting to every Fed move.

The Bottom Line

The Fed’s September 2025 rate cut highlights the importance of perspective. For long-term investors, staying focused on financial goals, diversified portfolios, and risk management matters more than short-term headlines.

👉 Looking to understand how Fed policy affects your retirement strategy or investment plan? Schedule a consultation with Anita Niefeldt, CFP®, today.